Table of Content

According to a report, 13% of day traders maintain consistent profitability over six months, and a mere 1% succeed over five years. This is primarily due to inadequate planning and undercapitalization. A well-crafted trading business plan can help you avoid these pitfalls, and this article will guide you.

In this article, you’ll learn:

- The current trends and growth forecasts in the stock trading industry

- A breakdown of the costs involved in starting a trading company

- The key components of a trading business plan (with a trading business plan example)

- Strategies for securing funding and overcoming the barriers to entry

By the end of this article, you’ll understand what it takes to create a business plan for an investment company, positioning your trading business for long-term success in this lucrative but highly competitive industry.

Pros and Cons of Trading Company

Let’s explore the pros and cons associated with running a trading company before diving into the specifics of a trading site business plan. Understanding them will help you make informed decisions:

Pros:

- Potential for significant profits.

- Flexibility in terms of time and location.

- Opportunity for continuous learning and skill development.

Cons:

- High risk due to market volatility.

- Emotional stress and psychological pressure.

- Requirement for constant vigilance and discipline.

Trading Industry Trends

Industry Size and Growth Forecast

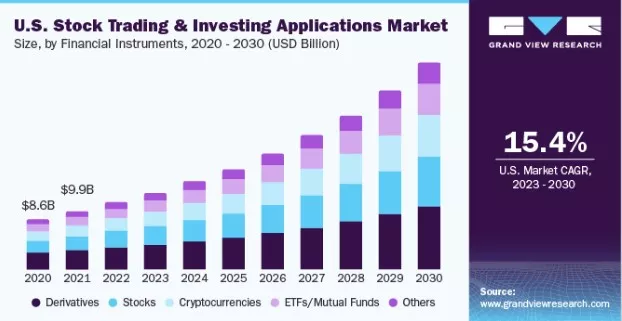

According to a report, the global stock trading and investing applications market size was at around $37.27 billion in 2022 and projects to grow at a CAGR of 18.3% from 2023 to 2030 (Source: Grand View Research). The following factors drive this growth:

- Increasing internet penetration

- Rising disposable income

- Growing awareness of investment opportunities.

(Image Source: Grand View Research)

The Services

As per our private equity firm business plan, a stock trading business offers various services, including:

- Execution Services:

- Facilitating Trades on behalf of clients

- Algorithmic trading services to automatically execute trades

- Research and Analysis:

- Market Insights (research reports, market analysis, and economic forecasts)

- Technical and Fundamental Analysis (price charts, historical data, and company fundamentals)

- Investment Recommendations

- Education and Training:

- Seminars and Webinars

- Online Courses

- Demo Accounts

- Risk Management Services:

- Portfolio Diversification

- Stop-Loss Orders

- Hedging Strategies

- Access to Markets and Exchanges:

- Direct Market Access (DMA)

- Global Market Access

- Technology Solutions:

- Trading Platforms

- Mobile Apps

- High-Frequency Trading (HFT)

- Compliance and Regulatory Support:

- Legal and Compliance Services

- Educate clients about Risk Disclosure

How Much Does It Cost to Start a Trading Company

According to Starter Story, you can expect to spend an average of $12,272 for a stock trading business. Some key startup costs include:

| Cost Category | Estimated Cost |

| Legal and Registration Fees | $1,500 |

| Website and Online Presence | $3,000 |

| Trading Software and Tools | $4,000 |

| Office Setup | $2,000 |

| Marketing and Advertising | $1,000 |

| Insurance | $500 |

| Initial Working Capital | $2,000 |

| Total Cost to Start a Trading Company | $14,000 |

How Much Can You Earn from a Trading Business?

Earnings in the trading business can vary significantly and depend heavily on:

- Trading strategy and approach

- Market conditions and volatility

- Risk management techniques

- Capital allocation and leverage

While specific income figures are difficult to predict due to these factors. However, here are some statistics showing the earning potential of a stock trading business:

- According to Investopedia, only around 5% to 20% of day traders consistently make money.

- According to Indeed Salaries, the average base salary for a stock trader in the U.S. is $80,086 per year.

- 72% of day traders ended the year with financial losses, according to FINRA.

- Among proprietary traders, only 16% were profitable, with just 3% earning over $50,000. (Source: Quantified Strategies)

What Barriers to Entry Are There to Start a Trading Company

Barriers to entry into the stock trading business include:

- Regulatory Requirements: Obtaining necessary licenses and registrations from governing bodies like the SEC and FINRA is a complex and time-consuming process.

- Capital Requirements: Trading activities require significant capital to manage risks and leverage opportunities, which can be a substantial challenge for new or small firms.

- Technological Expertise: Developing or acquiring sophisticated trading platforms, algorithms, and data analysis tools is costly and requires specialized expertise.

- Market Knowledge and Experience: Gaining in-depth knowledge and practical experience in the complex and dynamic financial markets takes years of dedicated study.

- Competitive Landscape: Breaking into the highly competitive trading industry dominated by established firms and well-funded proprietary trading desks is challenging for new entrants.

You can overcome these barriers by developing unique strategies, leveraging innovative technologies, and offering competitive and specialized services to differentiate yourself in the market. Do check our financial advisor business plan to learn more. If you’re considering a change in immigration status to facilitate your business, understanding the EB3 to EB2 conversion process in business can be vital for optimizing workforce and talent management.

Bank/SBA Business Plan

Creating a Trading Business Plan

A well-researched stock trading business plan is crucial to start a trading business. A general trading company business plan is a comprehensive document that defines your goals, strategies, and the steps needed to achieve them. It helps you stay organized and focused and increases your chances of securing funding if you plan to seek investors or loans. Consulting with a pitch deck specialist can be beneficial in preparing a compelling presentation for potential investors.

Steps to Write a Trading Business Plan

You can use a business plan template for a trading company or follow these steps to prepare a business plan for a personal trading business:

Step 1: Define Your Goals and Investment Objectives

Step 2: Conduct Market Research

Step 3: Develop Your Trading Strategy

Step 4: Establish Your Business Structure

Step 5: Develop a Financial Plan

Step 6: Outline Your Operational Procedures

Step 7: Create a Marketing and Growth Strategy

Step 8: Implement Risk Management

Step 9: Create an Exit Strategy

What to Include in Your Trading Business Plan

- Executive Summary

- Company Overview

- Market Analysis

- Trading Strategy and Risk Management

- Operations and Technology

- Financial Projections

- Management and Organization

- Appendices (e.g., research, charts, legal documents)

Here’s an online trading business plan sample of ABC Trading:

Executive Summary

ABC Trading is seeking $500,000 seed funding to launch its platform, acquire customers, and expand its team. An E2 visa business plan example can serve as a helpful guide if international expansion is a consideration.

- Vision – Becoming a leading online trading platform with a wide range of trading products and services.

- Values – Our core focus is innovation, excellence, integrity, and customer satisfaction.

- Target market – Tech-savvy and risk-tolerant investors looking for alternative ways to invest their money and diversify their portfolios.

- Revenue model – Commissions and fees for each trade, as well as subscription fees for premium features and services.

- Financial goal – Break even in the second year of operation and generate a net profit of $1.2 million in the third year.

ABC Trading is seeking $500,000 seed funding to launch its platform, acquire customers, and expand its team.

Company Overview

Company Name: ABC Trading

Founding Date: January 2024

Location: Delaware, USA

Registration: Limited Liability Company (LLC) in the state of New York

Regulated By: Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA)

Our team comprises seasoned professionals with diverse finance, mathematics, computer science, and engineering backgrounds.

Marketing Plan

Marketing Strategy: We aim to leverage online channels, such as social media, blogs, podcasts, webinars, and email newsletters, to create awareness, generate leads, and convert prospects into customers.

Marketing Objectives:

- Reach 100,000 potential customers in the first year of operation

- Achieve a 10% conversion rate from leads to customers

- Retain 80% of customers in the first year and increase customer lifetime value by 20% in the second year

The customer profile of ABC Trading includes the following characteristics:

- Age: 25-65 years old

- Gender: Male and female

- Income: Above $100,000 per year

- Education: Bachelor’s degree or higher

- Occupation: Professionals, entrepreneurs, executives, or retirees

- Location: US or international

- Trading experience: Intermediate to advanced

- Trading goals: Income generation, capital appreciation, risk diversification, or portfolio optimization

- Trading preferences: Stocks, options, or both

- Trading style: Technical, trend following, or volatility trading

- Trading frequency: Daily, weekly, or monthly

- Trading risk: Low, medium, or high

Marketing Tactics:

- Create and distribute engaging and informative content on social media platforms

- Offer free trials, discounts, referrals, and loyalty programs

- Collect and analyze customer feedback and data to improve and personalize the customer experience

- Partner with influencers, experts, and media outlets in the trading and finance niche

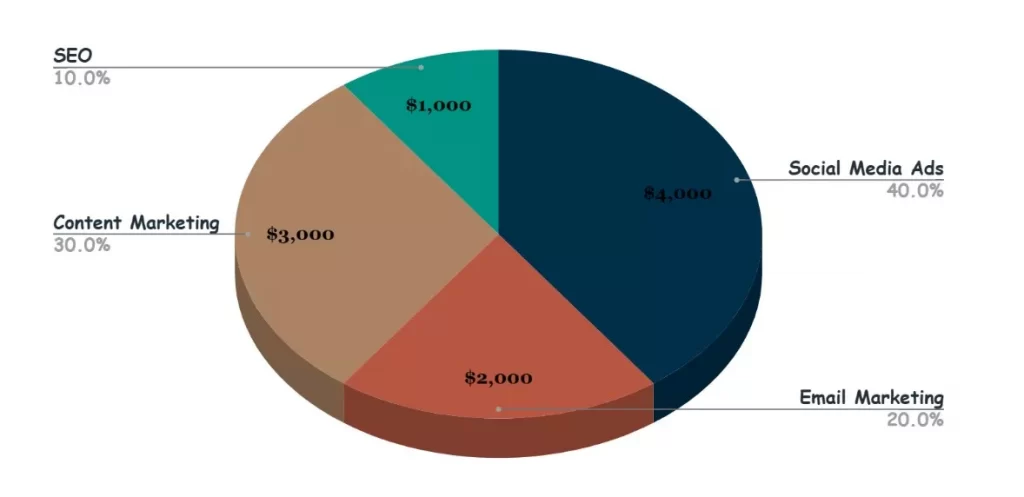

Marketing Budget:

We will allocate $10,000 for our marketing campaign, which we will use for the following purposes:

Operations Plan

ABC Trading’s operations plan ensures the smooth and efficient functioning of the company’s platform and services and compliance with the relevant laws and regulations.

Operation Objectives:

- Maintain a 99% uptime and availability of the company’s platform and services

- Ensure the security and privacy of the company’s and customers’ data and funds

- Provide timely and professional customer support and service

Operation Tactics:

- Use cloud-based servers and services

- Implement encryption, authentication, and backup systems

- Hire and train qualified and experienced customer service representatives and technicians

- Monitor and update the company’s platform and services regularly

- Follow the best practices and standards of the industry and adhere to the applicable laws and regulations

Operation Standards:

Financial Plan

ABC Trading’s financial plan is to provide a realistic and detailed projection of the company’s income, expenses, and cash flow for the next three years, as well as the key financial indicators and assumptions that support the projection.

Financial Objectives:

- Achieve a positive cash flow in the second year of operation.

- Reach a break-even point in the second year of operation.

- Generate a net profit of $1.2 million in the third year of operation.

- Maintain a healthy financial ratio of current assets to current liabilities of at least 2:1.

Financial Assumptions:

- Launch its platform and services in the first quarter of 2024

- Acquire 10,000 customers in the first year, 20,000 customers in the second year, and 30,000 customers in the third year

- Average revenue per customer will be $50 per month, based on the average number and size of trades and the subscription fees

- Average operating expense per customer will be $10 per month, based on the average cost of salaries, rent, utilities, marketing, and legal fees

- Pay a 25% tax rate on its net income

- Reinvest 50% of its net income into the company’s growth and development

Projected Income Statement:

| Fiscal Year | 2024 | 2025 | 2026 |

| Sales Revenue | $10,000,000 | $12,000,000 | $14,400,000 |

| Cost of Goods Sold | $6,000,000 | $7,200,000 | $8,640,000 |

| Gross Profit | $4,000,000 | $4,800,000 | $5,760,000 |

| Operating Expenses | $2,500,000 | $3,000,000 | $3,600,000 |

| Operating Income | $1,500,000 | $1,800,000 | $2,160,000 |

| Interest Expense | $100,000 | $90,000 | $80,000 |

| Income Before Taxes | $1,400,000 | $1,710,000 | $2,080,000 |

| Income Tax Expense | $420,000 | $513,000 | $624,000 |

| Net Income | $980,000 | $1,197,000 | $1,456,000 |

Projected Cash Flow Statement

| Fiscal Year | 2024 | 2025 | 2026 |

| Cash Flow from Operating Activities | |||

| Net Income | $980,000 | $1,197,000 | $1,456,000 |

| Adjustments for Non-Cash Items | |||

| Depreciation and Amortization | $200,000 | $220,000 | $242,000 |

| Changes in Working Capital | |||

| Accounts Receivable | -$200,000 | -$240,000 | -$288,000 |

| Inventory | -$300,000 | -$360,000 | -$432,000 |

| Accounts Payable | $150,000 | $180,000 | $216,000 |

| Net Cash Provided by Operating Activities | $830,000 | $997,000 | $1,194,000 |

| Cash Flow from Investing Activities | |||

| Capital Expenditures | -$500,000 | -$550,000 | -$605,000 |

| Net Cash Used in Investing Activities | -$500,000 | -$550,000 | -$605,000 |

| Cash Flow from Financing Activities | |||

| Proceeds from Borrowing | $200,000 | $0 | $0 |

| Repayment of Borrowing | -$110,000 | -$110,000 | -$110,000 |

| Dividends Paid | -$200,000 | -$240,000 | -$288,000 |

| Net Cash Used in Financing Activities | -$110,000 | -$350,000 | -$398,000 |

| Net Increase in Cash | $220,000 | $97,000 | $191,000 |

| Cash at Beginning of Period | $500,000 | $720,000 | $817,000 |

| Cash at End of Period | $720,000 | $817,000 | $1,008,000 |

Projected Balance Sheet

| Fiscal Year | 2024 | 2025 | 2026 |

| Assets | |||

| Current Assets | |||

| Cash | $720,000 | $817,000 | $1,008,000 |

| Accounts Receivable | $800,000 | $960,000 | $1,152,000 |

| Inventory | $900,000 | $1,080,000 | $1,296,000 |

| Total Current Assets | $2,420,000 | $2,857,000 | $3,456,000 |

| Non-Current Assets | |||

| Property, Plant and Equipment | $2,500,000 | $2,950,000 | $3,495,000 |

| Less: Accumulated Depreciation | -$200,000 | -$420,000 | -$662,000 |

| Net Property, Plant and Equipment | $2,300,000 | $2,530,000 | $2,833,000 |

| Total Non-Current Assets | $2,300,000 | $2,530,000 | $2,833,000 |

| Total Assets | $4,720,000 | $5,387,000 | $6,289,000 |

| Liabilities and Equity | |||

| Current Liabilities | |||

| Accounts Payable | $750,000 | $900,000 | $1,080,000 |

| Short-Term Debt | $200,000 | $90,000 | $0 |

| Total Current Liabilities | $950,000 | $990,000 | $1,080,000 |

| Non-Current Liabilities | |||

| Long-Term Debt | $900,000 | $800,000 | $700,000 |

| Total Non-Current Liabilities | $900,000 | $800,000 | $700,000 |

| Total Liabilities | $1,850,000 | $1,790,000 | $1,780,000 |

| Equity | |||

| Common Stock | $1,000,000 | $1,000,000 | $1,000,000 |

| Retained Earnings | $1,870,000 | $2,597,000 | $3,509,000 |

| Total Equity | $2,870,000 | $3,597,000 | $4,509,000 |

| Total Liabilities and Equity | $4,720,000 | $5,387,000 | $6,289,000 |

Fund a Trading Company

To successfully establish and operate a trading company, raising funds to finance daily operations and business expansion is crucial. There are different ways with their advantages and disadvantages:

1. Self-funding (Bootstrapping)

Self-funding, also known as bootstrapping, is when the founder or owner of the trading company uses their own personal savings, family business ideas, assets, or income to finance the business. This is the most common and simplest way to fund a trading company, especially in the early stages.

Pros:

- Complete ownership and control

- Flexibility in decision-making

- Potential for higher long-term returns

Cons:

- Limited access to capital

- Personal financial risk

- Slower growth potential

2. Debt Financing

Debt financing involves borrowing money from lenders, such as banks, credit unions, or microfinance institutions, to fund the trading company’s operations. The borrowed funds must be repaid with interest over a specified period.

Pros:

- Retain ownership and control

- Potential tax benefits from interest deductions

- Disciplined approach due to repayment obligations

Cons:

- Debt burden and interest payments

- Collateral requirements and personal guarantees

- Difficulty in securing financing for startups

3. Angel Investors

Angel investors are wealthy individuals who invest their own money into early-stage or high-potential trading companies in exchange for equity or convertible debt. Angel investors typically provide smaller funding than venture capitalists and offer mentorship, guidance, and access to their network.

Pros:

- Access to capital and industry expertise

- Potential for additional mentorship and guidance

- Lower risk compared to traditional investors

Cons:

- Dilution of ownership and control

- Potential for conflicting visions and expectations

- Limited resources compared to larger investors

4. Venture Capital (VC) Funding

Venture capital firms are professional investment firms that provide capital to high-growth startups in exchange for equity ownership. They typically invest large sums of money and are active in the company’s management and strategic direction.

Pros:

- Access to substantial capital for growth

- Expertise and industry connections from the VC firm

- Validation and credibility for the business

Cons:

- Significant dilution of ownership and control

- Intense pressure for rapid growth and return on investment

- Potential for conflicting visions and expectations

Depending on your business model, goals, and needs, you may also consider other options, such as grants, subsidies, partnerships, etc. Ensure to check for relevant documents, like the hedge fund private placement memorandum. The best way to fund your trading company is the one that suits your situation and preferences.

OGSCapital: Your Strategic Partner for Business Success

At OGSCapital, we specialize in professional business plans that empower startups, established companies, and visionary entrepreneurs. With over 15 years of experience, our seasoned team combines financial acumen, industry insights, and strategic thinking to craft comprehensive plans tailored to your unique vision. Whether you’re seeking funding, launching a new venture, or optimizing your existing business, we’ve got you covered.

If you have any further questions regarding how to write a business plan for your trading business, feel free to contact us. Our team at OGSCapital is here to support you on your entrepreneurial journey. You can also check our hedge fund business plan sample here.

Download Trading Business Plan Template in PDF

Frequently Asked Questions

What does a trading business include?

A trading business involves trading stocks and other financial instruments under a legal business structure. It includes:

- Market analysis

- Trading strategy

- Risk management

- Monitoring

- Testing

- Analysis

How does a trading company work?

A stock trading company facilitates the buying and selling of stocks (shares) on behalf of investors. These companies operate within stock exchanges, executing trades based on specific trading strategies.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rated document, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.