Table of Content

Do you want to start your own convenience store?

Are you planning to start a convenience store? Well, the yearly sales of the US convenience store industry exceed $680 billion so it is undoubtedly one of the most profitable businesses out there. As of December 31, 2016, there were more than 154,000 convenience stores in the US and their numbers are still increasing steadily.

The biggest reason of the popularity of this business is that the convenience stores offer various products which allow the consumers to obtain all their needs from a single roof thus keeping the traffic flowing day and night throughout the year. They are undoubtedly the need of the hour in today’s time where everyone is busier than ever. That is why this business starts yielding a profit as soon as it is launched as compared to most of the businesses which need months or even years to yield the desired rate of return.

Another important aspect is that, unlike other businesses, a convenience store business has the least amount of risk associated with it provided that you plan it successfully. So before you move on to open a convenience store, you will have to prepare a convenience store business plan which will establish the basis of your company’s future operations and decisions. It will help you determine everything; the types of products you will be selling, who your target customers will be and how you will allocate your resources for the required equipment, inventory, and payroll.

So, if you are wondering how to write an effective business plan, our SBA business plan writers are here to help. Below, we provide a detailed business plan example for a convenience store startup named ‘EasyShop’.

Executive Summary

2.1 The Business

EasyShop will be a bonded, insured and licensed convenience store business, located in the Manhattan borough of the New York City. We aim to serve the nearby residential community and working class of Manhattan by proving them all they need under a single roof.

We have strategically selected a furniture showroom, located in the main commercial center of downtown Manhattan, to be converted into our store. The location is ideal for opening convenience store since it is amidst all commercial and business activities and at a 10 minutes’ drive from the residential zone.

The business will be owned by Doug Spencer of Spencer family, one of the richest families in the United States. Mr. Spencer has been associated with the family business of fast-food restaurants for the last 20 years after doing his Masters in Business Administration from the Harvard University. Due to the similar family business, Mr. Spencer knows exactly how to start a convenience store and he has all the resources needed for starting a convenience store.

Although there are hundreds of already established convenience stores we have several competitive advantages over other competitors. The first one is our mobile app which can be used to make payments, order the goods for home delivery, or pre-book the goods. This app is strategically built to facilitate the ever-busy working class of the society. Our second competitive edge will be the availability of everything, every time. Unlike other stores, we will make sure that our stock never runs out and everything our customers may need is available to us. Finally, our customer service will be the best in town and will also give us an edge over other convenience stores.

2.2 Management

The company will be managed by Mr. Spencer himself and he will be assisted by his friend Carl John. Carl is highly experienced in retail businesses and will serve as the Chief Executive Officer of the EasyShop. The store will remain open 24-7 and will be operated and managed by three shifts of workers. A law firm will be contracted for covering the legal aspects of the business and an insurance firm will be contacted for insuring the company.

The convenience store industry is one of the few industries which have seen a constant increase in revenue along with the increase in business locations with time. The total sales from the US convenience store industry increased by approximately $80 billion within the course of one year from 2015 to 2016. The number of convenience stores has increased by 63% during the last three decades and is still on the rise. The main reason behind this increase is that it is very easy to open a convenience store as you can see from the hundreds of convenience store examples present in every city of the United States. The actual challenge is to successfully manage that convenience store to yield profits from the start.

2.3 Customers

The company aims to serve the community living in the residential zones of the Manhattan borough and the people working in the commercial and business centers located near us. The community living in our vicinity is financially established so we hope to have a lot of sales as soon as we are launched. There are also a lot of working-class people who are extremely tight up with their busy routines and prefer to go to a place where they can find everything under a single roof. We will provide the perfect place to our busy customers where they can find a huge number of products as well as services. This diversity of products and services will be one of our primary competitive advantages over other competitors.

We will provide every basic necessity of life to our customers under a single roof so that they don’t have to visit various stores in search of their needed goods. Some categories of the products offered by us include but are not limited to fresh and packed foods, beverages, meat, dairy products, stationery, personal care, healthcare products, baby items, pet items, newspapers, magazines, batteries, greeting cards, lottery tickets etc. We will offer money transfer services and utilities bill payment services to our customers. We will also provide home delivery services for online purchases to the nearby resident community. Customers can also pre-book their goods by using our smartphone app.

2.4 Target of the Company

The target of the company is to become the best convenience store business in the New York City within next five years of our startup. Ronald Spencer aims to become one of the biggest convenience store chains in the New York City within the next ten years of our launch. This target can only be achieved by growing the sales at the forecasted rate. We also aim to balance the initial cost of the startup with earned profits by the end of the first year and open multiple stores by the end of five years in the New York City.

The keys to the success of achieving our target are as follows:

- Comprehensive planning of ‘everything’

- Hiring the best staff for operations

- Respecting our customers and making sure that they get what they want in the least time

Company Summary

3.1 Company Owner

EasyShop will be owned by the Spencers, one of the richest families in the United States. Spencers are already operating a chain of fast food restaurants in North America but it was until this year that they have decided to enter the retail industry as well. The venture will be completely financed by the family while it will be led and operated by Doug Spencer.

Mr. Spencer is the eldest son of Ronald Spencer, the head of the family, and has been associated with the family business for the last 20 years after doing his Masters in Business Administration from the Harvard University. Mr. Spencer will be the General Manager of the business and will be assisted by his friend Carl John. John has served in multiple executive positions in various retail giants such as Wal-Mart, 7-Eleven, and Costco. For the last 6 years, John was serving in 7-Eleven as the Director Operations of the New York City.

3.2 Why the Business is being started

This business will basically provide a gateway for the Spencer family to enter the massive retail industry of the United States. Ronald had been planning this venture for a long time as it was undoubtedly the best way to invest the family’s wealth and profit earned via restaurants.

3.3 How the Business will be started

EasyShop will be initially launched as an open convenience store in the Manhattan borough of the New York City. A 15,000 square feet place has already been acquired on lease in the center of the main commercial district of downtown Manhattan. The place was formerly used as a furniture display showroom so a contracting firm has been hired to turn the place into a convenience store. A law firm, Wigdor LLP, has also been contracted for getting the permits and licenses from the city’s administration.

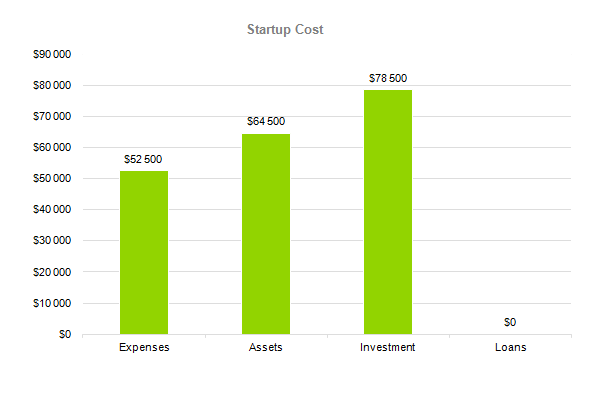

Spencer’s convenience store startup will be unique in many ways. It will remain open 24-7 and will be operated and managed by three shifts of workers with each shift working a standard eight hours a day. Mr. Spencer has planned everything about his business including the required equipment and inventory, and has hired experts from various fields to help him craft a detailed map about it. The financial experts have forecasted following costs for expenses, assets, investment, and loans for the Start-up.

The detailed start-up requirements, start-up funding, start-up expenses, total assets, total funding required, total liabilities, total planned investment, total capital and liabilities as forecasted by experts, is given below:

| Start-up Expenses | |

| Legal | $75,500 |

| Consultants | $0 |

| Insurance | $62,750 |

| Rent | $22,500 |

| Research and Development | $42,750 |

| Expensed Equipment | $42,750 |

| Signs | $1,250 |

| TOTAL START-UP EXPENSES | $247,500 |

| Start-up Assets | $0 |

| Cash Required | $322,500 |

| Start-up Inventory | $52,625 |

| Other Current Assets | $222,500 |

| Long-term Assets | $125,000 |

| TOTAL ASSETS | $121,875 |

| Total Requirements | $245,000 |

| START-UP FUNDING | $0 |

| START-UP FUNDING | $273,125 |

| Start-up Expenses to Fund | $121,875 |

| Start-up Assets to Fund | $195,000 |

| TOTAL FUNDING REQUIRED | $0 |

| Assets | $203,125 |

| Non-cash Assets from Start-up | $118,750 |

| Cash Requirements from Start-up | $0 |

| Additional Cash Raised | $118,750 |

| Cash Balance on Starting Date | $121,875 |

| TOTAL ASSETS | $0 |

| Liabilities and Capital | $0 |

| Liabilities | $0 |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| TOTAL LIABILITIES | $0 |

| Capital | $0 |

| Planned Investment | $0 |

| Investor 1 | $312,500 |

| Investor 2 | $0 |

| Other | $0 |

| TOTAL PLANNED INVESTMENT | $695,000 |

| Loss at Start-up (Start-up Expenses) | $313,125 |

| TOTAL CAPITAL | $221,875 |

| TOTAL CAPITAL AND LIABILITIES | $221,875 |

| Total Funding | $265,000 |

Services for customers

Being launched as one of the biggest convenience store business in the New York City, we plan to offer a huge number of products as well as services to our consumers. This diversity of products and services will be one of our primary competitive advantages over other competitors. We will provide every basic necessity of life to our customers under a single roof so that they don’t have to visit various stores in search of their needed goods. Some categories of the products offered by us include but are not limited to

- Meat – poultry, beef, lunch meat, pork

- Produce – fruits, vegetables

- Paper Goods – aluminum foil, sandwich bags paper towels, toilet paper

- Bread or Bakery products– sandwich loaves, tortillas, bagels, dinner rolls

- Baking Goods – cereals, pasta, mixes, flour, sugar

- Personal Care – shampoo, shaving cream, soap, hand soap

- Frozen Foods – waffles, vegetables, individual meals, ice cream

- Beverages – coffee, tea, juice, soda, drinks

- Canned or Jarred Goods – vegetables, spaghetti sauce, ketchup

- Dairy – cheese, eggs, milk, yogurt, butter

- Cleaners – all purpose, laundry detergent, dishwashing liquid and detergents

- Other – baby items, pet items, newspapers, magazines, batteries, greeting cards, lottery tickets

We will sell our products in the standard packaging sizes, quantity and quality as other as other convenience stores. We will sell the products of local as well as international brands such as Charmin, Stouffer’s, Frito-Lay, Jolly Green Coca-Cola, Giant etc.

One of the biggest problems in opening a convenience store is to incorporate some innovation in your business to make it unique and better as compared to the existing and established businesses. Considering this aspect, we will also offer money transfer services and utilities bill payment services to our customers. Customers can also pre-book their goods by using our smartphone app. We will also provide home delivery services for online purchases to the nearby resident community. There will be no delivery charges for goods worth greater than or equal to $50.

Note

Finally, we will offer ready-to-eat fast foods so that our customers can grab a bite despite their tight schedule.

Marketing Analysis of Convenience store business

The most important component of an effective convenience store business plan is its accurate marketing analysis that’s why Mr. Spencer acquired the services of marketing experts to help him through this phase. It is only after this stage that a good convenience store business plan could have been developed. After identifying the local market trends in the New York City, the marketing experts and analysts also helped him to select the best site for starting a convenience store business.

The success or failure of a convenience store totally depends upon its marketing strategy which can only be developed on the basis of accurate marketing analysis. There are four main steps to carry out an accurate marketing analysis which are to identify the current market trends of convenience store business, identify your target audience and potential customers, set out the business targets to achieve, and finally set the prices of your products and services. Marketing analysis is a must-do thing before you even think about how to start your own convenience store. It must be considered beforehand even if you are developing a small convenience store business plan.

Operational and Strategic Planning

5.1 Market Trends

The convenience store industry is one of the few industries which have seen a constant increase in revenue along with the increase in business locations with time. The total sales from the US convenience store industry generated in 2015 amounted to more than $603 billion while the sales exceeded $680 billion by the end of 2016. The sales increase by approximately $80 billion within the course of one year. Although these stats include the sales of the fuels since most of the convenience stores in the US primarily provide gas services but still merchandise makes a major chunk of these stats. As per other services provided by the convenience stores, the weekly wire transfers in 2015 were more than 5800.

The convenience store industry is subdivided according to the major categories of products it provides with the biggest being food service. Foodservice sales are growing to become the convenience store’s most profitable category, contributing 21.4% of sales as of 2016. Similarly, fresh fruits and vegetable sales (including salads and packaged products) also increased 10.3% to $362 million in 2014. The number of convenience stores has increased by 63% during the last three decades and, currently, they make up more than 34% of all retail outlets in the United States. After identifying these market trends, it is clearly evident that convenience store industry is always blooming and can be immensely profitable.

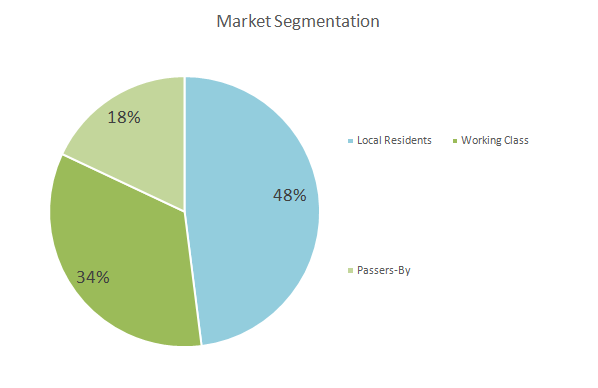

5.2 Marketing Segmentation

Our target market is the community living nearby at the 10 minutes’ drive from our store. The community consists of all types of people from varying backgrounds. As per the financial position, nearly half of the community has monthly income ranging from $40k to $50k while nearly 10% people have incomes even around $100,000. There are also a lot of working-class people who are extremely tight up with their busy routines and prefer to go to a place where they can find everything under a single roof.

For developing a good convenience store business model it was crucial to analyze the market segmentation of the future customers of our convenience store. A successful and efficient marketing strategy can only be developed after we completely know our potential customers. Our experts have identified the following type of target audience which can become the future consumers of our baby clothes:

The detailed marketing segmentation of our target audience is as follows:

5.1.1 Local Residents:

The first and the most numerous group of our customers will be the community living in the vicinity of our convenience store. These residents are financially stable and can become our potential customers of merchandise like food products and other accessories. These customers will also rely on us for money transfer and utilities bill payment facilities. This customer group will drive the most number of sales so our marketing strategy will be specifically built to attract this group towards us. Initially, we will also offer various promotional packages.

5.1.2 Working Class:

The second category includes the workers and employees who work in the businesses or offices located in the vicinity of our convenience store. Most of these workers have a tight routine and they prefer to get everything under a single roof as compared to visiting different stores. They want to shop as fast as they can without compromising on their busy schedule. Our convenience store is specifically designed while keeping such busy people in mind and the average time for shopping in our store will be around 3 to 4 minutes. Our ready-to-eat fast foods will always be ready for these people to pick up while on their way to their respective companies and offices.

5.1.3 Passers-by:

The third category includes those people who do not live or work near our convenience store but have come to the area for any business purpose or commercial activity. Most of the time these people need to pick some stuff for their homes while on the way to their respective destinations. They will also stop by us to grab some fast food or make some wire transfer.

The detailed market analysis of our potential customers is given in the following table:

| Market Analysis | |||||||||

| Potential Customers | Growth | YEAR 1 | YEAR 2 | YEAR 3 | YEAR 4 | YEAR 5 | CAGR | ||

| Local Residents | 48% | 22,334 | 32,344 | 43,665 | 52,544 | 66,432 | 10.00% | ||

| Working Class | 34% | 11,433 | 13,344 | 16,553 | 18,745 | 20,545 | 13.43% | ||

| Passers-by | 18% | 8,322 | 9,455 | 10,655 | 12,867 | 14,433 | 15.32% | ||

| Total | 100% | 42,089 | 55,143 | 70,873 | 84,156 | 101,410 | 9.54% | ||

5.3 Business Target

We aim to become the best convenience store business of the New York City within next five years of our startup. Ronald Spencer aims to become one of the biggest convenience store chains in the New York City within the next ten years of our launch. Our main business targets to be achieved as milestones over the course of next three years are as follows:

- To achieve the net profit margin of $10k per month by the end of the first year, $15k per month by the end of the second year, and $25k per month by the end of the third year

- To balance the initial cost of the startup with earned profits by the end of the first year

- To open up two more stores by the end of three years, three more stores by the end of five years

5.4 Product Pricing

Product pricing is one of the most important factors in deciding the strategy for convenience store marketing. Selecting the price for products is a difficult task, especially for the startups, because one have to attract customers while yield profit at the same time. These two things cannot be achieved at the same time and the only way out is to select a compromised trade-off or balance between the two.

After considering the market demands, we have priced all our products in the similar ranges as of our competitors except for some of our food products. Our food products of Spencer brand will be nearly 10% cheaper so as to attract customers toward us. The reason behind our pricing policy is to achieve the minimum attractive rate of return which would not be possible in case of offering our other products for low prices.

Strategy

Great Work!!

Had the pleasure of working with Alex on a BP for a new venture. The end result looks very professional. His communication is always prompt and he was very patient with my detailed requests. I would definitely work with this company in the future.

Like marketing analysis, sales strategy is also an important component of the business plan for a convenience store. After identifying the market trends, the market demand, and the potential customers of the startup, the next step is to develop an ingenious strategy to attract those customers toward us. Mr. Spencer carried out an extensive research about various marketing and advertising strategies being implemented on established grocery store business model before developing an effective sales strategy for EasyShop.

6.1 Competitive Analysis:

Convenience store industry is one of the biggest industries of the United States making up 34% of all retail stores located in the United States. There are over 150,000 convenience stores in the United States; likewise, there are hundreds of established convenience stores in the New York City that’s why we have a really tough competition ahead of us.

Considering this fact, we have already made preparations for entering the massive retail industry of the United States. Our biggest competitive edge over other competitors will be our mobile app which can be used to make payments, order the goods for home delivery, or pre-book the goods. By pre-booking the goods, you don’t have to spend time on searching for all the goods at the store as one of our salesmen will have already collected them for you to pick up on the way. We have strategically built this app to facilitate the ever-busy working class of the society.

Our second competitive edge will be the availability of everything, every time. Unlike other stores, we will make sure that our stock never runs out and everything our customers may need is available with us. We will provide all kind of goods as compared to conventional convenience stores. Finally, our customer service will be the best in town. We will treat every customer with utmost respect and make sure that our customers leave our stores with big smiles on their faces.

6.2 Sales Strategy

After carrying out a detailed grocery store industry analysis, our experts came up with the following brilliant ideas to advertise and sell ourselves.

- We will carry out a large-scale social media campaign for our advertisement.

- We will allow our customers to buy our products online through our Facebook page and mobile app. Customers can pay online, order or pre-book their required goods.

- We will offer various discounts and gifts on our products for the first month of our launch to encourage sales.

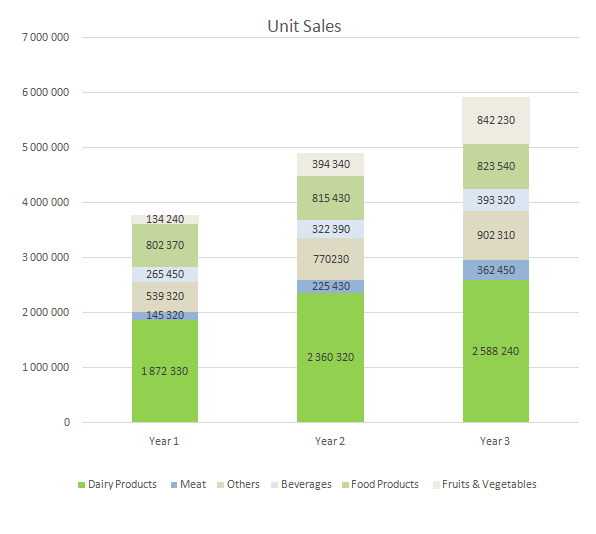

6.3 Sales Forecast

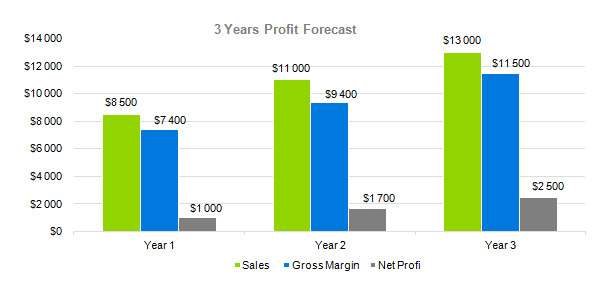

Considering our innovative app, the quality and availability of our products, and our unparalleled customer service, our sales pattern is expected to increase with years. By analyzing our market segmentation strategy, our experts have forecasted the following sales on a yearly basis which are summarized in the column charts.

The detailed information about sales forecast, total unit sales, total sales is given in the following table:

| Sales Forecast | |||

| Unit Sales | Year 1 | Year 2 | Year 3 |

| Dairy Products | 187,330 | 260,320 | 258,240 |

| Meat | 802,370 | 815,430 | 823,540 |

| Others | 539,320 | 770230 | 1,002,310 |

| Beverages | 265,450 | 322,390 | 393,320 |

| Food Products | 1,435,320 | 1,250,430 | 1,762,450 |

| Fruits & Vegetables | 134,240 | 394,340 | 842,230 |

| TOTAL UNIT SALES | 3,364,030 | 3,813,140 | 5,082,090 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Dairy Products | $140.00 | $150.00 | $160.00 |

| Meat | $600.00 | $800.00 | $1,000.00 |

| Others | $700.00 | $800.00 | $900.00 |

| Beverages | $650.00 | $750.00 | $850.00 |

| Food Products | $140.00 | $120.00 | $100.00 |

| Fruits & Vegetables | $1,150.00 | $1,300.00 | $1,450.00 |

| Sales | |||

| Dairy Products | $214,800 | $274,000 | $333,200 |

| Meat | $120,050 | $194,500 | $268,500 |

| Others | $50,110 | $71,600 | $93,000 |

| Beverages | $139,350 | $194,600 | $249,850 |

| Food Products | $62,350 | $72,300 | $82,250 |

| Fruits & Vegetables | $229,500 | $365,500 | $501,500 |

| TOTAL SALES | |||

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| Dairy Products | $0.70 | $0.80 | $0.90 |

| Meat | $0.40 | $0.45 | $0.50 |

| Others | $0.30 | $0.35 | $0.40 |

| Beverages | $3.00 | $3.50 | $4.00 |

| Food Products | $0.70 | $0.75 | $0.80 |

| Fruits & Vegetables | $3.00 | $3.50 | $4.00 |

| Direct Cost of Sales | |||

| Dairy Products | $98,300 | $183,000 | $267,700 |

| Meat | $66,600 | $119,900 | $173,200 |

| Others | $17,900 | $35,000 | $52,100 |

| Beverages | $19,400 | $67,600 | $115,800 |

| Food Products | $27,700 | $69,200 | $110,700 |

| Fruits & Vegetables | $64,200 | $224,700 | $385,200 |

| Subtotal Direct Cost of Sales | $294,100 | $699,400 | $1,104,700 |

Personnel plan

The key to the success of a business is its careful planning in the initial stages. Just like the planning of other components, you must also prepare a personnel plan before you think about how to start a grocery store business. It is also an extremely important stage because success of any business significantly depends upon its employees. So you have to prepare a plan for the staff needed whether you are developing a convenience store business plan for a small shop.

It is never easy to estimate the number and type of staff needed for a company before it is even launched therefore it is always better to seek the help of HR experts to get through this phase. Mr. Spencer acquired the services of experts to help him developed the following personnel plan for his company.

7.1 Company Staff

Mr. Spencer will act as the General Manager of the company while Carl John will serve as the Chief Executive Officer of the company. The company will initially hire following people in t:

- 1 Store Manager to manage the operations of the store

- 2 Administrators / Accountants to maintain financial records

- 4 Sales Executives responsible for marketing and discovering new ventures

- 10 Employees for operating and maintaining the store

- 2 Inventory Manager to manage the merchandise present in store and storage

- 1 Supply Chain Manager to purchase goods for the store

- 5 Drivers to transport products from storage to store and for delivering products to customers

- 4 Cleaners to keep the store clean at all times

- 1 Front Desk Officer to act as a receptionist

- 2 Security Officers

To ensure the best quality service, all employees will be selected through vigorous testing and will be trained for a month before starting their jobs.

7.2 Average Salary of Employees

The following table shows the forecasted data about employees and their salaries for next three years.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Store Manager | $85,000 | $95,000 | $105,000 |

| Administrators / Accountants | $45,000 | $52,000 | $59,000 |

| Sales Executives | $85,000 | $92,000 | $109,000 |

| Employees | $410,000 | $440,000 | $480,000 |

| Inventory Managers | $66,000 | $73,000 | $80,000 |

| Supply Chain Manager | $35,000 | $42,000 | $59,000 |

| Drivers | $60,000 | $63,300 | $70,000 |

| Cleaners | $63,300 | $70,000 | $76,700 |

| Front Desk Officer | $20,000 | $23,300 | $30,000 |

| Security Officers | $40,000 | $45,000 | $52,000 |

| Total Salaries | $784,300 | $855,600 | $963,700 |

Financial Plan

After deciding the strategy and personnel plan of the company, the next step was to develop a detailed map about the financial projections covering all aspects of the company. Just like the planning of other aspects, you must also prepare a financial plan before you start thinking about how to start a convenience store business. The financial plan should craft a detailed map about the cost of startup, inventory, payroll, equipment, rent, utilities and how these costs will be covered with the earned profits. Before getting to think about how to start a convenience store, cost and profit analysis should be carried out.

Mr. Spencer hired experts to incorporate the financial aspect in the convenience store business plan. The financial plan outlines the development of the company over the next three years and is specifically developed to achieve both the company’s short-term and long-term objectives.

8.1 Important Assumptions

The company’s financial projections are forecasted on the basis of following assumptions. These assumptions are quite conservative and are also expected to show deviation but to a limited level such that the company’s major financial strategy will not be affected.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 11.00% | 12.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 26.42% | 27.76% | 28.12% |

| Other | 0 | 0 | 0 |

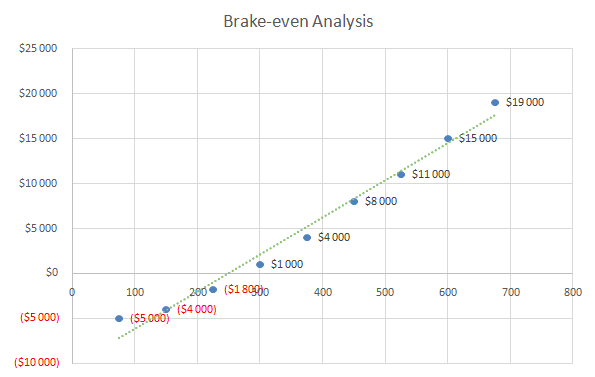

8.2 Brake-even Analysis

The following graph shows the company’s Brake-even Analysis.

The following table shows the company’s Brake-even Analysis.

| Brake-Even Analysis | |

| Monthly Units Break-even | 5530 |

| Monthly Revenue Break-even | $159,740 |

| Assumptions: | |

| Average Per-Unit Revenue | $260.87 |

| Average Per-Unit Variable Cost | $0.89 |

| Estimated Monthly Fixed Cost | $196,410 |

8.3 Projected Profit and Loss

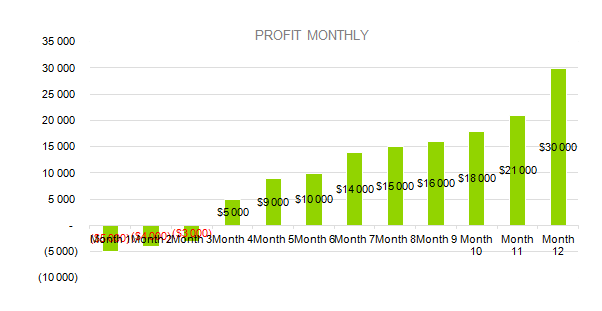

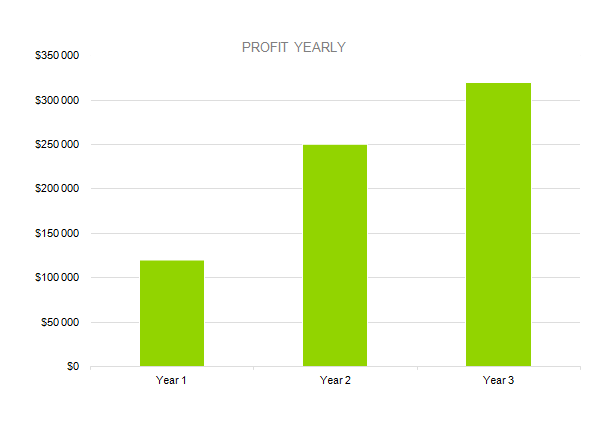

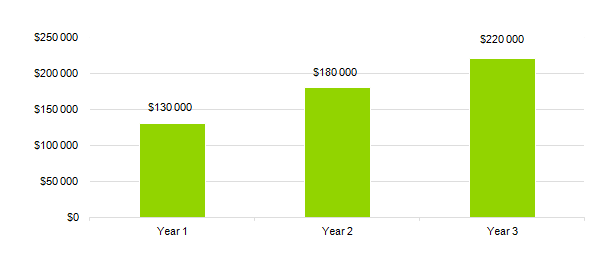

The following charts show the company’s expected Profit and Loss situation on the monthly and yearly basis.

| Pro Forma Cash Flow | |||

| Cash Received | Year 1 | Year 2 | Year 3 |

| Cash from Operations | |||

| Cash Sales | $40,124 | $45,046 | $50,068 |

| Cash from Receivables | $7,023 | $8,610 | $9,297 |

| SUBTOTAL CASH FROM OPERATIONS | $47,143 | $53,651 | $59,359 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| SUBTOTAL CASH RECEIVED | $47,143 | $53,651 | $55,359 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $21,647 | $24,204 | $26,951 |

| Bill Payments | $13,539 | $15,385 | $170,631 |

| SUBTOTAL SPENT ON OPERATIONS | $35,296 | $39,549 | $43,582 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| SUBTOTAL CASH SPENT | $35,296 | $35,489 | $43,882 |

| Net Cash Flow | $11,551 | $13,167 | $15,683 |

| Cash Balance | $21,823 | $22,381 | $28,239 |

8.3.1 Profit Monthly

The following graph shows the monthly profit, as forecasted by the company’s financial experts.

8.3.2 Profit Yearly

The following graph shows the yearly profit, as forecasted by the company’s financial experts.

8.3.3 Gross Margin Monthly

The following graph shows the monthly gross margin, as forecasted by the company’s financial experts.

8.3.4 Gross Margin Yearly

The following graph shows the yearly gross margin, as forecasted by the company’s financial experts.

The following table shows detailed information about profit and loss, and total cost of sales.

| Pro Forma Profit And Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $309,069 | $385,934 | $462,799 |

| Direct Cost of Sales | $15,100 | $19,153 | $23,206 |

| Other | $0 | $0 | $0 |

| TOTAL COST OF SALES | $15,100 | $19,153 | $23,206 |

| Gross Margin | $293,969 | $366,781 | $439,593 |

| Gross Margin % | 94.98% | 94.72% | 94.46% |

| Expenses | |||

| Payroll | $138,036 | $162,898 | $187,760 |

| Sales and Marketing and Other Expenses | $1,850 | $2,000 | $2,150 |

| Depreciation | $2,070 | $2,070 | $2,070 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $4,000 | $4,250 | $4,500 |

| Insurance | $1,800 | $1,800 | $1,800 |

| Rent | $6,500 | $7,000 | $7,500 |

| Payroll Taxes | $34,510 | $40,726 | $46,942 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $188,766 | $220,744 | $252,722 |

| Profit Before Interest and Taxes | $105,205 | $146,040 | $186,875 |

| EBITDA | $107,275 | $148,110 | $188,945 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $26,838 | $37,315 | $47,792 |

| Net Profit | $78,367 | $108,725 | $139,083 |

| Net Profit/Sales | 30.00% | 39.32% | 48.64% |

8.4 Projected Cash Flow

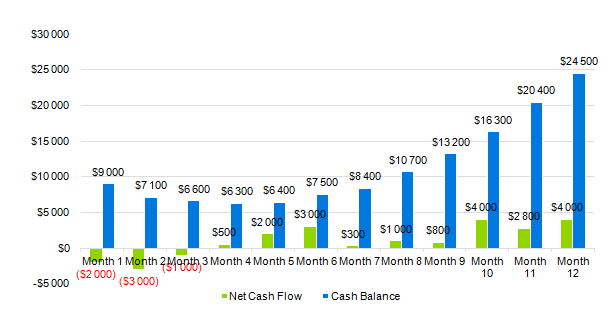

The following column diagram shows the projected cash flow.

8.5 Projected Balance Sheet

The following table shows detailed data about pro forma cash flow, subtotal cash from operations, subtotal cash received, sub-total spent on operations, subtotal cash spent.

The following projected balance sheet shows data about total current assets, total long-term assets, total assets, subtotal current liabilities, total liabilities, total capital, total liabilities and capital.

| Pro Forma Balance Sheet | |||

| Assets | Year 1 | Year 2 | Year 3 |

| Current Assets | |||

| Cash | $184,666 | $218,525 | $252,384 |

| Accounts Receivable | $12,613 | $14,493 | $16,373 |

| Inventory | $2,980 | $3,450 | $3,920 |

| Other Current Assets | $1,000 | $1,000 | $1,000 |

| TOTAL CURRENT ASSETS | $201,259 | $237,468 | $273,677 |

| Long-term Assets | |||

| Long-term Assets | $10,000 | $10,000 | $10,000 |

| Accumulated Depreciation | $12,420 | $14,490 | $16,560 |

| TOTAL LONG-TERM ASSETS | $980 | $610 | $240 |

| TOTAL ASSETS | $198,839 | $232,978 | $267,117 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $9,482 | $10,792 | $12,102 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| SUBTOTAL CURRENT LIABILITIES | $9,482 | $10,792 | $12,102 |

| Long-term Liabilities | $0 | $0 | $0 |

| TOTAL LIABILITIES | $9,482 | $10,792 | $12,102 |

| Paid-in Capital | $30,000 | $30,000 | $30,000 |

| Retained Earnings | $48,651 | $72,636 | $96,621 |

| Earnings | $100,709 | $119,555 | $138,401 |

| TOTAL CAPITAL | $189,360 | $222,190 | $255,020 |

| TOTAL LIABILITIES AND CAPITAL | $198,839 | $232,978 | $267,117 |

| Net Worth | $182,060 | $226,240 | $270,420 |

8.6 Business Ratios

The following table shows data about business ratios, ratio analysis, total assets, net worth.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | INDUSTRY PROFILE | |

| Sales Growth | 4.35% | 30.82% | 63.29% | 4.00% |

| Percent of Total Assets | ||||

| Accounts Receivable | 5.61% | 4.71% | 3.81% | 9.70% |

| Inventory | 1.85% | 1.82% | 1.79% | 9.80% |

| Other Current Assets | 1.75% | 2.02% | 2.29% | 27.40% |

| Total Current Assets | 138.53% | 150.99% | 163.45% | 54.60% |

| Long-term Assets | -9.47% | -21.01% | -32.55% | 58.40% |

| TOTAL ASSETS | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 4.68% | 3.04% | 2.76% | 27.30% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 25.80% |

| Total Liabilities | 4.68% | 3.04% | 2.76% | 54.10% |

| NET WORTH | 99.32% | 101.04% | 102.76% | 44.90% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 94.18% | 93.85% | 93.52% | 0.00% |

| Selling, General & Administrative Expenses | 74.29% | 71.83% | 69.37% | 65.20% |

| Advertising Expenses | 2.06% | 1.11% | 0.28% | 1.40% |

| Profit Before Interest and Taxes | 26.47% | 29.30% | 32.13% | 2.86% |

| Main Ratios | ||||

| Current | 25.86 | 29.39 | 32.92 | 1.63 |

| Quick | 25.4 | 28.88 | 32.36 | 0.84 |

| Total Debt to Total Assets | 2.68% | 1.04% | 0.76% | 67.10% |

| Pre-tax Return on Net Worth | 66.83% | 71.26% | 75.69% | 4.40% |

| Pre-tax Return on Assets | 64.88% | 69.75% | 74.62% | 9.00% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 19.20% | 21.16% | 23.12% | N.A. |

| Return on Equity | 47.79% | 50.53% | 53.27% | N.A. |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 4.56 | 4.56 | 4.56 | N.A. |

| Collection Days | 92 | 99 | 106 | N.A. |

| Inventory Turnover | 19.7 | 22.55 | 25.4 | N.A. |

| Accounts Payable Turnover | 14.17 | 14.67 | 15.17 | N.A. |

| Payment Days | 27 | 27 | 27 | N.A. |

| Total Asset Turnover | 1.84 | 1.55 | 1.26 | N.A. |

| Debt Ratios | ||||

| Debt to Net Worth | 0 | -0.02 | -0.04 | N.A. |

| Current Liab. to Liab. | 1 | 1 | 1 | N.A. |

| Liquidity Ratios | ||||

| Net Working Capital | $120,943 | $140,664 | $160,385 | N.A. |

| Interest Coverage | 0 | 0 | 0 | N.A. |

| Additional Ratios | ||||

| Assets to Sales | 0.45 | 0.48 | 0.51 | N.A. |

| Current Debt/Total Assets | 4% | 3% | 2% | N.A. |

| Acid Test | 23.66 | 27.01 | 30.36 | N.A. |

| Sales/Net Worth | 1.68 | 1.29 | 0.9 | N.A. |

| Dividend Payout | 0 | 0 | 0 | N.A. |

Download Convenience Store Business Plan Sample in pdf

OGS capital professional writers specialized also in themes such as, donut shop business plan, beauty supply store business plan, boutique store business plan and many other business plans.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rated document, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.